Musings #4

The COGS of You

I like the idea of thinking about your professional life as an independent business.

Most people have one customer (employer) and one price (salary). That’s the revenue.

COGS is how I suspect most people spend their time - they take what they already know how to do (the COGS) and use that to earn income (revenue) from that one customer. That’s how most jobs work, and even a lot of other productive endeavors. Sure, you will learn along the way and get incrementally better, but generally it is trading time and existing skill for money (and hopefully other forms of comp, purpose, etc.).

Being more “intentional about R&D” is a great mindset to have - being a continuous learner, reading, taking courses, and taking focused blocks of time to get better. Spending time or money on developing new skills or to deepen expertise makes a lot of sense if you think of it as an R&D investment that can improve your output, revenue potential, and competitive advantage. You probably wouldn’t invest in company that doesn’t consistently spend human or financial capital on R&D, so why wouldn’t you do so for your self?

This analogy also extends to sales & marketing. For businesses, S&M is a dedicated function for complete with branding, content marketing, outreach, etc. For the business of you, perhaps it makes sense to also be more intentional about sales & marketing, beyond just having a LinkedIn profile and sending out resumes when needed.

A related concept but a slightly different analogy and unit of measurement: I have often wondered why we don’t have three statement financial models for individuals. If that is such a great way to account for a business and analyze it, why not for your personal wealth and income?

I think the answer is it is too hard and too few would care. But seems like this would unlock so many interesting metrics and ways to view your personal finances. Your clothes and car payments go into your COGS. Education and books are R&D. Your house is on your balance sheet both equity and debt, with the interest payments hitting your income statement.

Knowing your operating margin, earnings growth, debt/equity, and a host of other metrics would be very informative, especially if you can track them over a long period of time.

Guest Passes Vs. Invites

In Musings #1, I highlighted the power of memberships versus subscriptions:

Memberships are not tied to a transaction, but rather bestow a status or identity (with benefits, of course): “I am a Costco member” rather than “I shop at Costco”. “I belong” rather than “I subscribe”.

The difference may be powerful enough that some companies position their services as memberships even if they are functionally subscriptions. For example, Netflix makes an active choice to always refer to its customers as members, not subscribers.

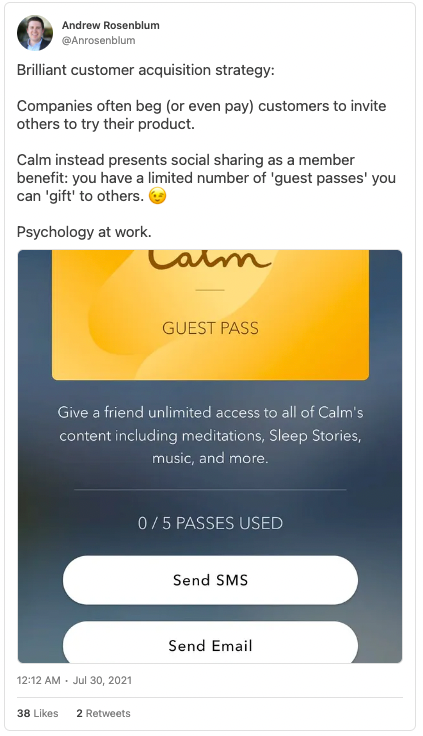

Calm, the sleep/meditation app, generally uses the “subscription” terminology, but taps into this membership concept with a great twist on the standard invite/referral link to get existing customers to invite their friends:

I suspect this has a much higher gifting rate and acceptance rate than a typical “invite with a free trial” strategy.

IPO Employee Letters

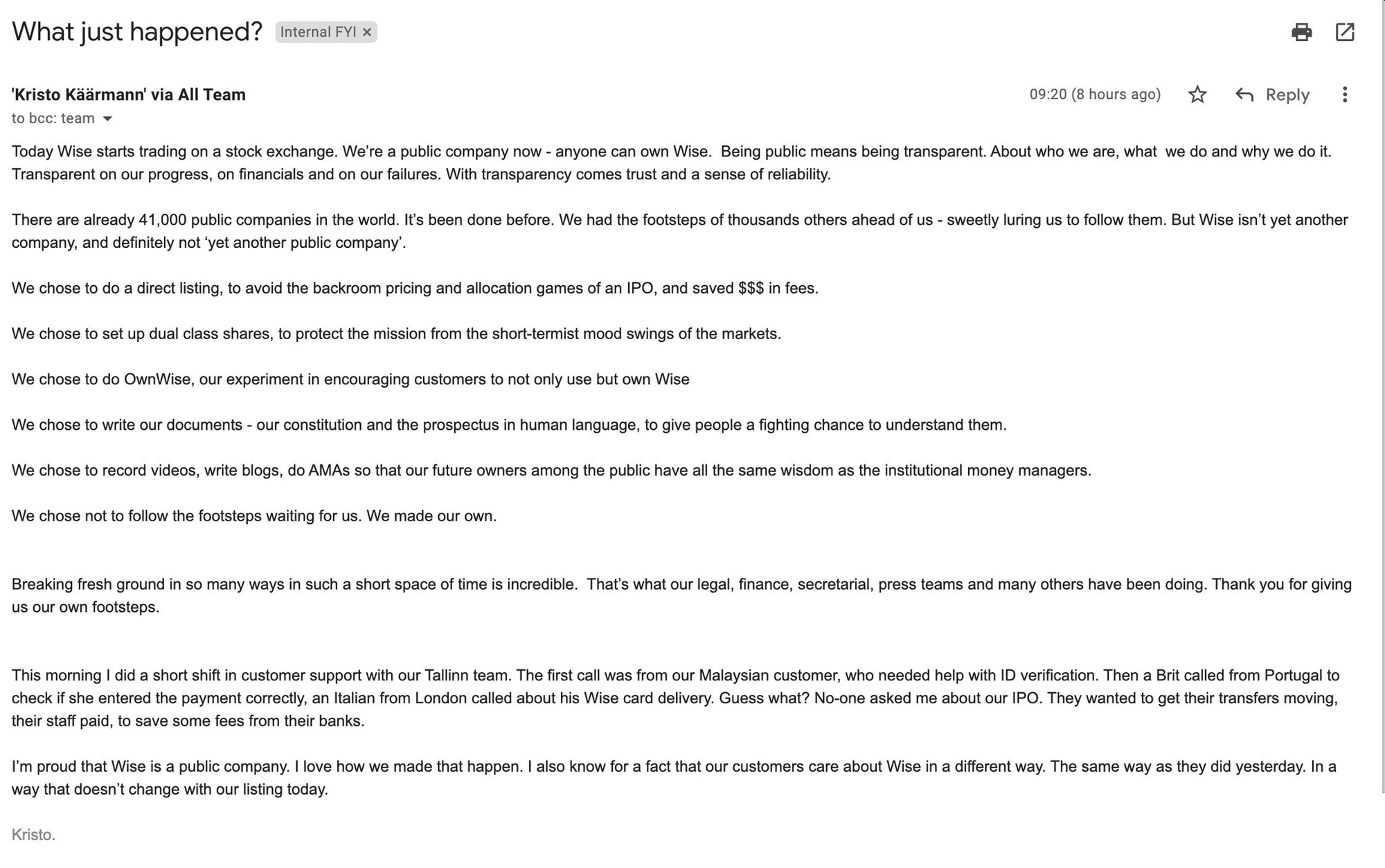

A few weeks ago when the payment company, Wise, went public, the CEO sent a letter to its employees explaining what happened.

This part is what I was hoping to see and was not disappointed:

This morning I did a short shift in customer support […]. Guess what? No-one asked me about our IPO. They wanted to get their transfers moving, their staff paid, to save fees from their banks.

I’m proud that Wise is a public company. I love how we made that happen. I also know for a fact that none of our customers care about Wise in a different way. The same way as they did yesterday. In a way that doesn’t change with our listing today.

Love this mindset and messaging (and also that he did a shift in customer support). These glimpses into a company’s culture can be great signals to outside stakeholders about the direction of a company.

Here is the full email:

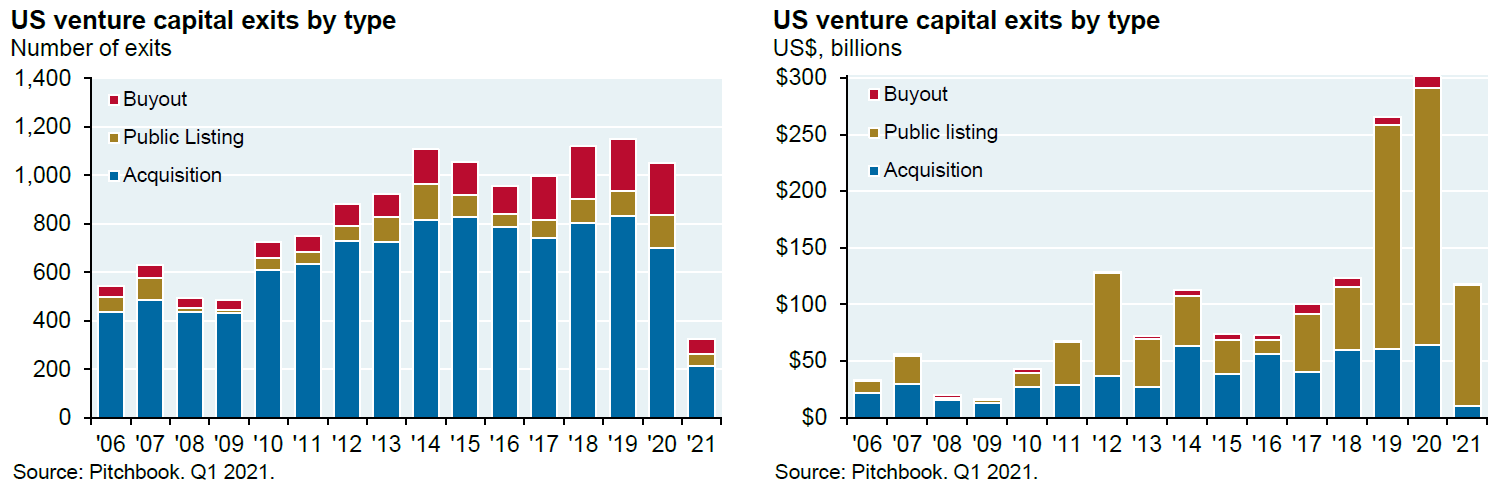

In particular, this type of employee messaging over an IPO event is very healthy because going public is often branded as an endpoint - it is literally called an “exit” by investors. Yet for the company itself, becoming a public company is just a step on a long journey. It is more of a beginning than an end.

This is especially true given most of the value created for VC-backed companies in recent years is from those that go public, not those that are acquired:

There are a lot of factors at play here and it may be the case for many companies that acquisition is the optimal outcome. But the best companies are typically ones that build businesses that can remain independent, which at the same time makes them more valuable to acquirers.

If you have any other examples of IPO letters to employees (not to investors), please pass along - I suspect there would be a strong correlation of the good ones having better-than-average share price returns in the following years.

Curveballs

I capture highlights from all the things I read. A few noteworthy ones of late:

-

“After all, these kids were very young when their parents gave them iPhones and tablets—they’ve never known a self that wasn’t subject to anonymous virtual observation. And so it may well be that whatever we mean by “authentic” here isn’t the standard definition that Rousseau and the Romantics first fathomed—a true effusion of your unvarnished personality—but is “authentic” in the sense that their identities have been made in perfect, unconscious sympathy with whatever their mob of online followers has deemed agreeable and inoffensive.” - The Anxiety of Influencers (Barrett Swanson)

-

“I was able to analyze approximately 2 million externally facing links found in articles at nytimes.com since its inception in 1996. We found that 25 percent of deep links have rotted. (Deep links are links to specific content—think theatlantic.com/article, as opposed to just theatlantic.com.) The older the article, the less likely it is that the links work. If you go back to 1998, 72 percent of the links are dead. Overall, more than half of all articles in The New York Times that contain deep links have at least one rotted link.” - The Internet Is Rotting (Jonathan Zittrain)

-

“Hell isn’t a fire pit but a museum of regrets.” - The Fifth Science (Exurb1a)

Photo of the Week

From a trip to Hawaii, I call this one “Land Monster Eating the Ocean”.

Swimming in this cove was magical, made even more so by the journey. To get to this place, we had to walk along the coast for an hour or so in a maze of green, yellow, and black. Seeing this amazing formation appear on the horizon and then approaching it from this angle made the payoff a million times better.