Musings #8

CAC is Not the New Rent

I keep hearing this axiom that “CAC is the new rent.”

If you’re not familiar, you’re not missing out. But it keeps popping up even though it doesn’t make much sense.

As far as I can tell, the entry into the lexicon came from a 2018 Inc article on DTC companies, where the argument went like this:

In other words, for companies reliant on paid marketing, their digital customer acquisition cost (CAC) is a lot like paying for brick-and-mortar stores in the old model, or selling wholesale. Essentially, this undermines one of the most basic precepts of the DTC movement, that these companies are cutting out the middleman and therefore can afford to charge much less for higher-quality goods.

Basically, for online businesses, whatever cost savings are achieved from not paying rent on physical stores are supposedly replaced by having to spend a lot on digital marketing.

This phrase is catchy and perhaps sounds smart.

Except that it is the wrong way to look at it. CAC is not the new rent.

Trying to pseudomorphically fit old concepts to new paradigms is easy thinking, but it is almost always wrong and short-sighted. That is especially true here.

In the physical world, yes, you have rent, but you still also have CAC. You still need to acquire customers. A storefront might get you some organic acquisition (foot traffic), but regardless of the business, you still need to spend capital on sales and marketing to generate awareness and bring customers to the store.

Online is not that different. You have a website, which generates some organic acquisition (search results, etc.), and you also have sales and marketing through various channels.

Presence plus marketing. The components are the same in both cases.

So really, the better analogy is that a website is the new rent. Both are fixed costs and the medium through which the customer experiences your business. But that’s obvious, and the analogy falls apart because today every offline business also needs a web presence. So “website is the new rent” probably doesn’t make it into any pithy tweets.

The main CAC difference between web businesses and brick & mortar is that with the latter you are geographically constrained and you likely don’t know who your customers are. As a result, your sales and marketing efforts reflect those limitations - less targeted, more local, and less digital.

Rent is also a fixed cost whereas CAC is typically more variable (it can have fixed components such as personnel salaries), which has important managerial and valuation implications. For example, if an offline business wants to acquire more customers, short of opening a new storefront which is more of a capital expenditure, it can’t just pay more rent to its landlord. Instead, it could increase sales & marketing efforts or work on numerous other things that drive customer acquisition… which are the same mechanics as a purely online business.

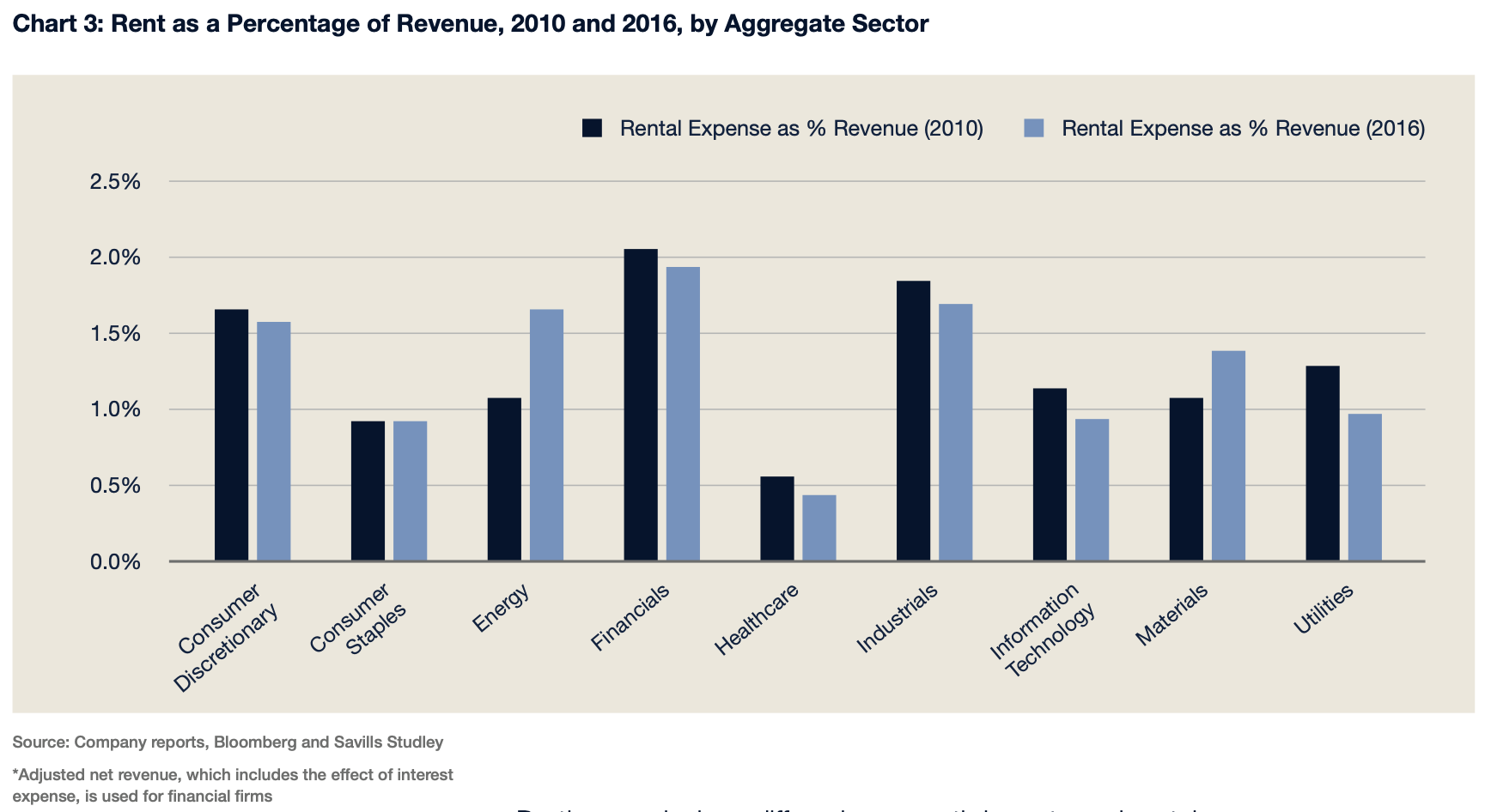

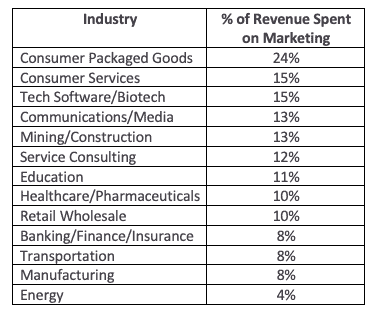

Lastly, rent and CAC aren’t even of a comparable magnitude. Rent as a percent of revenue for most businesses is quite small. For example, rent expense as a percentage of revenue for the S&P 500 is less than 2 percent.

Meanwhile, marketing (as a proxy for CAC) as a percent of revenue is typically 10%+ and for CPG is well north of 20%.

CAC is not the new rent because they are fundamentally different concepts with different properties. It’s time to retire this cliche.

Visualizing Data without Oversimplifying

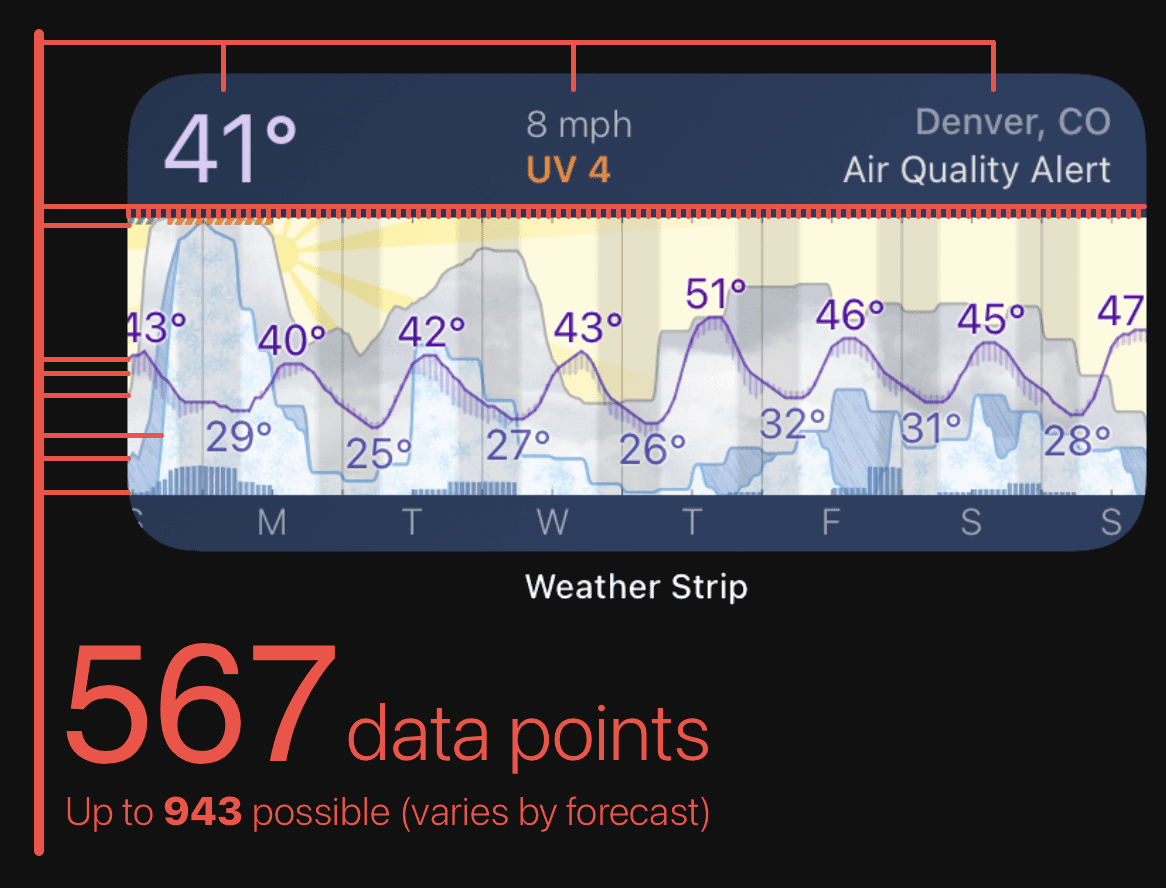

As an analytics professional, I love a good visualization. Especially when it coveys a lot of data without reducing information. One frustrating trend in design is the oversimplification of data into just one or two data points. What could be a line chart is often reduced to a single number. It may look nice and provide basic utility, but the designer is catering to the lowest common denominator.

Instead, a better principle is to respect the user. Assume some level of capability and you’ll be rewarded with those types of users. These are the users with higher retention and higher LTV, anyways.

A good recent example of this is a weather app called Weather Strip, which conveys magnitudes more information on a single screen than more mainstream weather apps.

Compared to the basic Apple Weather app:

Not bad, just oversimplified. Different audience.

The conversion-to-paid strategy for Weather Strip is refreshing and effective as well:

- A personal welcome note from the developer (with his picture) when you first open the app saying that you can subscribe to continue using after two weeks of full access. The full access part is important - many companies provide a trial but limit the features, which is backward.

- After two weeks (with zero other prompts), another authentic note outlining why there is a charge (to not ever have to use ads or sell data to monetize).

Well worth the buck or two per month.

Curveballs

Highlights from things I’ve read:

-

“Early finance is analytics. Early finance isn’t accounting, it’s not accounts receivables, it’s not payroll or procurement. It’s not even forecasting and planning. As I’ve written about before, the role of the first finance hire is to grow the business through organizing frameworks and analysis.” - The first operator - the case for ‘finance and analytics’ (Bobby Pinero)

-

“We can think of the world as made up of things. Of substances. Of entities. Of something that is. Or we can think of it as made up of events. Of happenings. Of processes. Of something that occurs. Something that does not last, and that undergoes continual transformation, that is not permanent in time. The destruction of the notion of time in fundamental physics is the crumbling of the first of these two perspectives, not of the second.” - The Order of Time (Carlo Rovelli)

-

“Take note if you find yourself wondering “Where is my good knife? Or, where is my good pen?” That means you have bad ones. Get rid of those.” - 103 Bits of Advice I Wish I Had Known (The Technium)