Musings #10

Generative AI

In my last Musings in July, I mentioned some text-to-image AI models and included an image from Dalle-mini with the following simple prompt: “a hockey player on the moon photorealistic”.

This was the result, which is neat but admittedly is very far from great.

Fast forward to last month when Stable Diffusion was released. Here is the result from the exact same prompt as above:

That’s pretty close to what I wanted! And I’m sure can be better with a more detailed prompt.

it isn’t quite a fair comparison as Dalle-mini wasn’t state of the art at the time, although it was the most accessible. DALLE-2 and Midjourney were public (though limited), and others such as Imagen and Parti from Google were announced but not available to the public. While DALLE-2 and Midjourney were groundbreaking, both came with many gates and lacked accessibility.

And then Stability.ai completely changed the game with a fully open-source release of Stable Diffusion. It has been the starting point of an explosion of use cases and applications built on top.

Stability.ai is now reportedly raising capital at a $1B valuation. Perhaps the ultimate bullish indicator for generative AI: Getty Images bans AI-generated content.

The advances in these AI models this year have been truly incredible. In my view, the release of Stable Diffusion marks a momentous point in the advancement of how AI and technology impact our lives, even if only for trailblazing an open-source path so AI can be open to all. Likely not by coincidence, OpenAI’s latest release of Whisper (speech-to-text) was open-source instead of gated, and the waitlist for DALLE-2 was recently removed.

To try Stable Diffusion for yourself, the official dream studio is good, or Playground AI is really amazing for discovery as well as creating your own images (can select from either Stable Diffusion or DALLE-2).

For just exploring the possibilities, Lexica.art, “the Stable Diffusion search engine”, is phenomenal.

Comparisons between Midjourney, DALLE-2, and Stable Diffusion:

DALL-E 2 vs Midjourney vs StableDiffusion mega thread: photography, illustration, painters, abstract

— fabians.eth (@fabianstelzer) August 20, 2022

these image synths are like instruments - it's amazing we'll get so many of them, each with a unique "sound" 🤯

rules: same prompt, 1:1 aspect ratio, no living artists pic.twitter.com/47syy7uPJJ

A really neat video combining famous paintings, demonstrating what can be done with outpainting:

Merging art with AI 🖼 ⁇ 🖼 ⁇ 🖼

— Orb Amsterdam (@OrbAmsterdam) September 9, 2022

Using the new Outpainting capability of DALL-E 2, we asked @OpenAI to help us imagine how the landscape could look like between famous impressionist paintings from Van Gogh, Monet, Munch and Hokusai. pic.twitter.com/WSfXnk99Yw

If you’re not impressed yet, check out this artist who is creating amazing art with Midjourney.

Lastly, I loved this meta comment from thesephist:

We burned dead forests to teach sand how to paint itself and critique its own existence in our language. Ghosts of decayed trees and ancient rocks speaking its own self-portraits into existence. pic.twitter.com/UpdcdWAbsd

— Linus (@thesephist) August 23, 2022

Growth vs Value

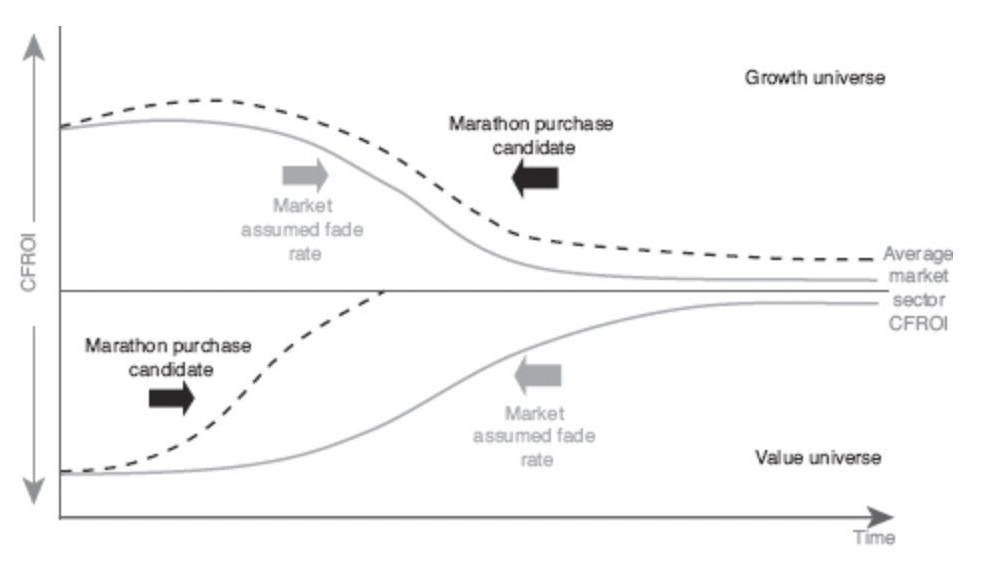

I thought this framing of growth investing and value investing was quite interesting:

via Lillian Li

Rather than the more common (and vastly oversimplified) conceptualization of growth = high growth + high multiple and value = low growth + low multiple, this is one way to think about where your intensity delta comes from. Is it expecting that a high ROI shifts even higher and for a longer period, or that a low ROI will improve faster than the market expects?

That said, I strongly disagree with the idea that both groups converge on a long-run average return. That makes some sense for growth companies as returns naturally decrease with size. But for companies with low ROI to begin with? There is limited compelling rationale to support the idea that bad companies will get better just because.

Anchoring on an “average market sector CFROI” is kind of like setting the terminal value growth rate in a DCF to ~3% because that is the average long-term GDP growth rate (or another similar rationale). That’s nice and all, but the real reason is it makes the terminal value a reasonable number (or desired number, in many cases). Reality is very different.

With those reservations, this framework is still useful to add to the toolkit, especially since it nicely incorporates time as a vector.

Adoption Curves of Pandemic Darlings

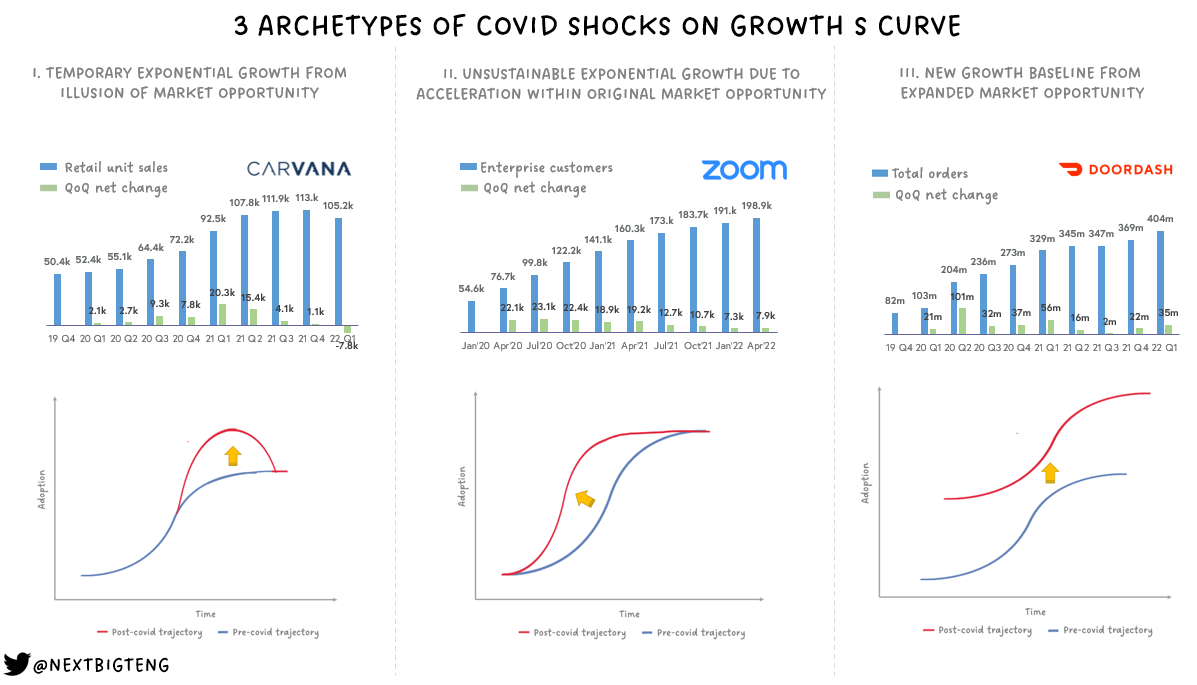

Speaking of curves, this is a great illustration of how adoption curves shifted during the pandemic for different companies in different ways.

The full post from Janelle Teng goes into more detail. It is interesting how the market generally failed to distinguish between these shifts during the 2020-2021 run-up. While all of these are positive shifts to adoption curves, they mean very different things for long-term value.

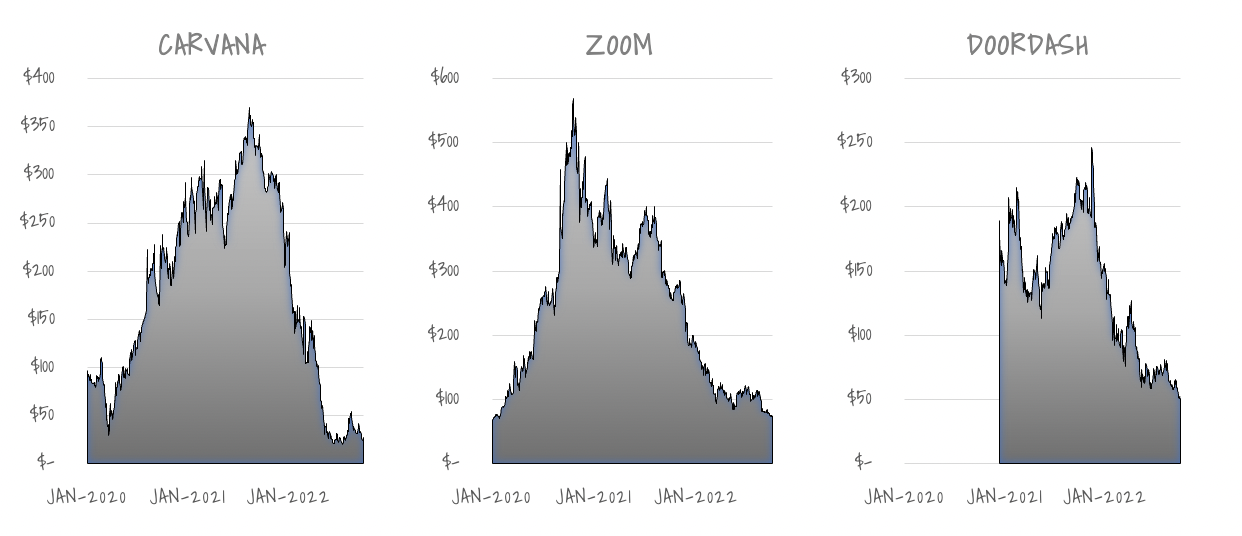

For reference, here are the stock price charts of each since 2020:

The bigger question is whether the market is currently pricing these stocks appropriately now that we know how these shocks turned out (abstractly, anyways).

Curveballs

-

“Behavioral economics today is famous for its increasingly large collection of deviations from rationality, or, as they are often called, ‘biases’. While useful in applied work, it is time to shift our focus from collecting deviations from a model of rationality that we know is not true. Rather, we need to develop new theories of human decision to progress behavioral economics as a science.” - We don’t have a hundred biases, we have the wrong model (Jason Collins)

-

“Professional money management requires no credentials and has few startup costs. That increases the number of people who try their hand – there are now more than 16,000 mutual funds and 10,000 hedge funds in the US. For perspective there are 15,444 Starbucks locations in the U.S. It’s inevitable that the vast, vast, majority will be mediocre at best.” - It’s Supposed To Be Hard (Morgan Housel)

-

“This isn’t an endorsement of some carpe diem philosophy, where we should live life like there’s no tomorrow. Quite the opposite: We should live life like there’s no yesterday. If our habits, our preferences, and even our identities help us do, like, or be the things we want to do, like, or be next, hold on to them. If not, let it go.” - The past is not precious (Benn Stancil)